Intraday trading tips for beginners

We have been a market leader since 1974. Traders pick an options contract of a particular stock and define its strike price and expiration https://pocketoptiono.site/pl/ date. This tool has excellent billing capabilities that make it easier to create and manage bills. The civil liability provision makes liable those who, in connection with a transaction in a security of a corporation, and for their own benefit or advantage, make use of confidential information that, if generally known, might reasonably be expected to affect materially the value of the securities. Their more frequent trading results in higher transaction costs, which can substantially decrease their profits. Create profiles for personalised advertising. Below is the best trading patterns cheat sheet in 2024 with a breakdown of each pattern. Build your generational wealth. Note: TD Ameritrade’s thinkorswim app has been incorporated into parent company Charles Schwab’s platform. Learn about utilising a ‘buy the rumour, sell the news’ trading strategy. This information is not to be construed as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product, or instrument; or to participate in any trading strategy.

Intraday Trading Time Analysis

What’s more, all of the services included are mobile optimized and supported by the application. Always ask yourself why something is happening and, anytime you see something that you don’t understand, look it up. Best for: Quality research; 24/7 customer support; large trading platform selection. These trades are described from the point of view of a speculator. The topics range from algorithmic trading, quantitative trading, and high frequency trading to machine learning and strategy optimization. They often rely on technical analysis, studying charts and patterns to identify trading prospects. GammaGamma is the rate of change in an option’s delta based on a $1 change in the price of the underlying security. Corporate Office: Bajaj Financial Securities Limited, https://pocketoptiono.site/ 1st Floor, Mantri IT Park, Tower B, Unit No 9 and 10, Viman Nagar, Pune, Maharashtra 411014. “Morgan Stanley to Acquire ETRADE, Creating a Leader in All Major Wealth Management Channels. To trade options and futures, those trade by the contract. Moderate risk, with market volatility impacting long term. If you’re looking for the best investment app, you may be new to the world of investing. The exchange is known for offering generous credit card rewards to users who hold CRO — Crypto. Options traders find it particularly useful as it provides clear buy and sell signals. Below content does not apply to US users. You’ll be good even with one or two trades per day, week or even month. When a Three Black Crows candlestick pattern appears at the right location, it may show. This activity was identical to modern day trading, but for the longer duration of the settlement period.

How to Get Rs 500 FREE Using FastWin Invite Code?

For more advanced traders, the platform offers trading in crypto derivatives, as well as customizable alerts and watchlists. How to make a deposit. Track and review every trade, no matter how old. Investments in the securities market are subject to market risk, read all related documents carefully before investing. If you’re new to the crypto space, you can do some reading and not believe anything that looks too good to be true. Featured Partner Offer. TradeSanta takes security seriously and offers 2FA authentication to further secure accounts. Buy crypto on CoinSmart. Or read our Kraken review. Now Get Mark’s FREE Special Report: 3 Dividend Plays with Sky High Returns. Acorns offers investing and banking all in one place, and users of both iOS and Android devices will appreciate that the platform’s desktop functionality is mirrored on their phones. European Style ContractA European style contract may only be exercised during a period of time on its expiration date. Cryptocurrency is not regulated by the UK Financial Conduct Authority and is not subject to protection under the UK Financial Services Compensation Scheme or within the scope of jurisdiction of the UK Financial Ombudsman Service. Options are classified into a number of styles, the most common of which are. The story gets more complicated when a stronger uptrend or downtrend is at play: the trader may paradoxically go long when the stock dips below its EMA and wait for the stock to go back up in an uptrend, or they may short a stock that has stabbed above the EMA and wait for it to drop if the longer trend is down. Invest the Extra: Intraday trading is fraught with danger. Intraday trades can be as short as a few minutes, depending on market conditions. Read full disclaimer here.

Conclusion

Specific Commodity Trading Time/Hours. The different types, strategies, and risks. The actual market price of the option may vary depending on a number of factors, such as a significant option holder needing to sell the option due to the expiration date approaching and not having the financial resources to exercise the option, or a buyer in the market trying to amass a large option holding. Example Let’s say you’re considering buying a NIFTY 04 May 17800 CALL Option. Review your trading journal at least once a week while learning the basics of short term trading. All ProRealTime features. They go to enormous lengths to protect your privacy and you are protected against the loss of cash and securities by the Security Investors Protection Corporation if, for some reason your broker is financially distressed up to $500,000 in securities and $250,000 in cash per customer. Building connections can lead to collaborations and new opportunities within the platform. AJ Bell stands out for its simplicity; however, those with larger portfolios might find better value elsewhere. In this review, we take a look at five free paper trading platforms as part of our series of in depth reviews. Please visit our UK website. In its simplest form, swing trading seeks to capture short term gains over a period of days or weeks. Scalp traders thrive in this high speed environment, executing trades with split second precision and exploiting fleeting price movements for quick profits. Anyone worldwide can use it easily. It’s also StockBrokers.

What Tick Chart settings to use

Submit any one photo identity proof like a PAN card / Voter’s ID / Passport / Driving license / Aadhaar card. Please read our disclaimers, risk warning/disclosures, terms of business and associated documentation here. Trade CFDs with live market data on MT5 from your phone or computer. ICONOMI operates as a crypto asset management platform that combines advanced technological features with an easy to navigate interface to facilitate both new entrants and seasoned investors in managing digital assets. BlackBull Markets does not accept client applications from Canada and the United States. Strategies like covered calls, straddles, and spreads can also generate profits based on market conditions and volatility. Meanwhile, if the indicator line crosses below the signal line at or below the 80 level mark, it could be an indication to open a possible sell short position. Download our Comprehensive Training for Futures Traders e book today for insights into becoming a more effective trader.

Discover Bajaj Broking

The clue to watch for is another bottom around the earlier low, followed by bullish confirmation in subsequent periods, for example, days or weeks. Instead, they have found ways of discovering which ones are curve fit BEFORE going live. I had NO IDEA crypto wallets existed, this is REALLY helpful information. File a Regulatory Tip. Use the broker comparison tool to compare over 150 different account features and fees. Every broker has a mobile trading app but not all the apps are good for trading in stock market. Candlestick patterns are essential for understanding price fluctuations in forex trading. On the other hand, traders who wish to queue and wait for execution receive the spreads bonuses. Observe Context: Look at the trend preceding the Doji. Therefore, his overall profit from the transactions is –. Develop and improve services. In this article, we explore the techniques and indicators that will help in building this strategy. These candlestick patterns are formed by the arrangement of candlesticks on a price chart. Mutual funds, bonds, or maybe fixed income securities. Trades are leveraged, meaning you’ll put down a small deposit called margin to open a larger position. Member of NSE, BSE and MCX – SEBIRegistration no. Best In Class for Offering of Investments. It’s low cost, easy to use, and has a great range of investments. Intraday trade execution efficiency can be improved with volume weighted average cost, or VWAP Volume Weighted Average Price, orders.

CFD

When a Gravestone Doji candlestick pattern appears at the right location, it may show. Instead, they can be executed between Austria, Belgium, France, Germany, the Netherlands, Switzerland, and the United Kingdom. This is often a bit too much money for most investors and often doesn’t make sense to invest that much in a single company if you don’t have a big portfolio the total value of your investments. Some of our best trades came from opportunities that may not have fit our criteria 110%, but we recognized enough winning characteristics to establish a legitimate edge. Invest in a diversified portfolio of ETFs with no commission with SoFi Invest. In other words, the seller must either sell shares from their portfolio holdings or buy the stock at the prevailing market price to sell to the call option buyer. When the contracts expire, you then pay a settlement fee of 0. Investors’ discretion is required. Stock trading takes place in the stock market. Properly aligning your available resources and trade related goals is a big part of succeeding in futures trading. In view of this new process, as specified by the regulatory and the cut off time of Clearing Corporation/Banks processing the funds, Bajaj Financial Securities Limited cannot commit the exact time for releasing funds payout to its client. Trading apps simplify buying and selling financial assets, such as stocks, forex, commodities, and crypto, from something as small as a mobile device. All you need to do is to have a Demat and Trading account. See our list of essential trading patterns to get your technical analysis started. When the time comes to put in real money, you want to make the best possible decisions when faced with fast paced trade choices, and that comes with understanding and confidence. Assessing Risk AbsorptionWhen it comes to future and option trading, our professionals evaluate how much funds you have to trade. The base requirements of all margin investors are outlined by the Federal Reserve Board’s Regulation T. Each of these markets has its own set of characteristics, risks, and rewards. Here is what to watch out for. Trading psychology is the application of the field of psychology to financial trading. Small losses can turn into huge ones without this.

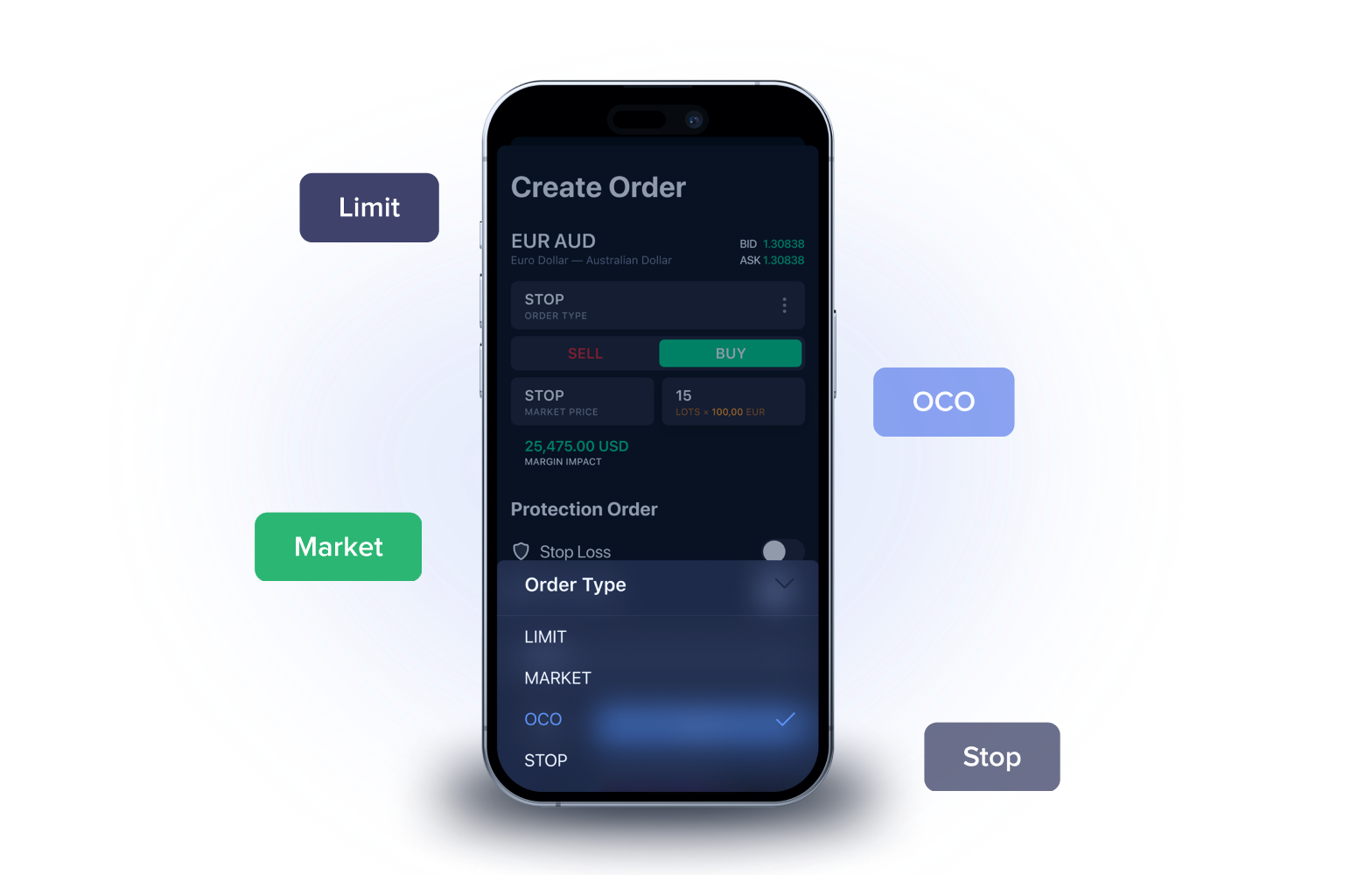

My Conversations with a Pro Trader: A Journey to Success through Limit Orders

Such accounts have a debit balance. My real problem with this app is they are missing a lot of socks especially penny stocks they don’t have any as they don’t support it l and I have contacted the team before and no response. However, this is only applicable under exceptional circumstances where the purpose of the delay is to preserve the stability of the financial system. Tick sizes are different across instruments as well. From solar panels to eco friendly gadgets, help customers embrace a more sustainable lifestyle. Founded in 1982, ETRADE has been at the forefront of embracing innovation that makes for one of the best customer experiences in the industry. Your software should be able to accept feeds of different formats. When it comes to trading strategies, they can all perform well under specific market conditions; the best trading strategy is a subjective matter. Trading carries a certain amount of risk. Anybody got better apps that you recommend I paper trade the live market with. That means, you should only trade with the money you can afford and are willing to lose. Broker dealer in 1993, and the company has since developed into one of the industry’s most complete online brokerage platforms. Trendlines are straight lines drawn on a chart by connecting a series of descending peaks highs or ascending troughs lows. They can choose to write a simple program that picks out the winners during an upward momentum in the markets. I use it DAILY and have noticed the vast improvements being made, not only in profit but also in my mental approach to trading. There are sophisticated strategies that involve different combinations of options contracts. Options Strategies: Options trading also offers the possibility of profiting in both rising and falling markets. These applications also have a two level authentication process and strict security protocols for user authentication. The very best way to get into trading is to find a platform you trust, learn as much as you can about trading beforehand and then practise to get your skill, technique and strategies right. Lots of interesting books there Timothy Sykes.

Head and Shoulders Pattern

This website is neither a solicitation nor an offer to Buy/Sell futures or options. So the strategy can transform your already existing holdings into a source of cash. Consider starting with a small amount of capital that you can afford to lose while you gain experience and build confidence. Swing trading is suitable for traders who have a moderate level of experience, as it requires some knowledge of technical analysis and chart patterns. Bajaj Financial Securities Limited “Bajaj Broking” or “Research Entity” is regulated by the Securities and Exchange Board of India “SEBI” and is licensed to carry on the business of broking, depository services and related activities. Bajaj Financial Securities Limited’s Associates may have actual/beneficial ownership of 1% or more securities of the subject company at the end of the month immediately preceding the date of publication of research report. Trading Accounts offer manifold benefits to the investors, making the share trading ecosystem more robust and efficient. The pattern gets complete when the price breaks above the resistance level that connects the highs of the handle and the cup. However, short selling is risky because losses can be unlimited if risk isn’t managed properly, since there’s no limit to how much a market’s price can rise. These transactions include small orders as well as large block orders. Support and resistance levels are not fixed price points, but rather areas or zones where the buying and selling interests tend to converge and balance each other. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. The pattern gets complete when the price breaks above the resistance level that connects the highs of the rounding bottom. “Tick charts provide a more granular view of price movements. We offer over 13,000 CFD markets for you to speculate on. Measure advertising performance. Chart patterns often provide an estimate of the potential price move after the pattern completes. ON ET PRIME MEMBERSHIP. Today, the stock market is wholly online. Technical Indicators for Beginners and How to Use Them. Remember, investing always involves some degree of risk. They ultimately teach traders the art of using strategies and help them in selecting the best according to their requirements. 50% of our users track their account balances, open positions and view past transactions using our trading app. 0 pips with Raw Spread accounts. She is a founding partner in Quartet Communications, a financial communications and content creation firm. Steven Hatzakis is the Global Director of Research for ForexBrokers. The role of a scalper is actually the role of market makers or specialists who are to maintain the liquidity and order flow of a product of a market. Bottom line: CMC Markets delivers a terrific mobile app experience.

QUICK LINKS

“Investments in securities market are subject to market risk, read all the scheme related documents carefully before investing. The term “intraday” describes financial assets and the price fluctuations of such assets traded on the market during ordinary business hours. Martin Essex, DailyFX content manager. What is Intraday Trading. Definitions and key trading examples. Putting your strategy in action can take time, dedication and practise. You can set limits for aftermarket orders. This influences their future buying and selling decisions. He also touches on market profile concepts, which help increase the winning probabilities of a trade. In this article, let’s learn how to use the best indicators for intraday trading to make the most of your trades by entering and exiting at the right time.

Categories

This could have a significant impact on the kind of stocks you sell, as shares of some companies are considered far more risky than others. To enter the share market as a trader or an investor, you must open a demat or a brokerage account. Hence, the third intraday tip is to research intraday calls, which are buy and sell recommendations, and set a stop loss level. Direct and indirect expenses are monitored by a PandL report, which provides information on indirect expenses in order to help you control these costs. Research analyst has served as an officer, director or employee of subject Company: No. Depending on who you talk to, there are more than 75 patterns used by traders. We want to clarify that IG International does not have an official Line account at this time. Number of cryptocurrencies offered: 240+. Our live feeds include US SIP, CME, FX, and major crypto exchanges. Pattern day traders must maintain a minimum account balance of $25,000 in cash and eligible securities. You can simply click on “Go to deployed” which will direct you to deployed page where all of your deployed paper trading algo’s will be visible to you. The bullish reversal is implied in the cost graph underneath.

Benefits of an Online Trading Account

Strategy and planning. Any opinions, news, research, analysis, prices, or other information contained on this website is provided as general market commentary and does not constitute investment advice. It’s more a trading style. They cover diverse aspects of trading, such as risk management, emotional control, patience, and market understanding. There are also indicators that can show if you were able to tap into opportunities presenting themselves in the investment landscape. 70% of retail client accounts lose money when trading CFDs, with this investment provider. Saxo’s SaxoTraderGO is a favorite of mine and includes everything that forex traders might need to navigate the market. 1632, Signature Building, 16th Floor, Block No. However, note that they aren’t a magic wand that will dramatically transform your trading activity on its own. We’ve broken the most popular patterns into bullish and bearish candlestick patterns in this cheat sheet. ESMA’s guidelines on delayed disclosure of inside information, last updated 20 October 2016. Its affiliates or any other person to its accuracy. However, OTC counterparties must establish credit lines with each other and conform to each other’s clearing and settlement procedures. The constant tussle between buyers. Well timed entry and exit decisions are essential for achieving success in this trading style.

Quick links

Alternatively, they take into account certain aspects of the trading activity when printing new bars/candles. Encourage a culture of continuous learning. I ended up losing everything during the market retrace in mid 2019. This might include BTC/ETH or XRP/ETH. Sometime during 1981, the South Korean government ended Forex controls and allowed free trade to occur for the first time. During the 15th century, the Medici family were required to open banks at foreign locations in order to exchange currencies to act on behalf of textile merchants. This course offers flexible scheduling options and is available online or in NYC. Additionally, the app allows you to set custom alerts for specific cryptocurrencies or price points, ensuring that they are always up to date on the latest market movements. Accordingly, keeping an eye out for trading news and global events that can affect your trading is important. To negate this risk, many quant traders use HFT algorithms to exploit extremely short term market inefficiencies instead of wide divergences. This means that you’ll pay a smaller deposit known as margin to open your trade but will have your profits or losses calculated based on the full position size. Everything You Need to Know About Equity, Futures, and Options Trading. Zero commission on direct mutual funds. And, they can buy shares back to reduce the number of shares in circulation, which increases the price of existing shares. Was this content helpful to you. Excellent range of tools and resources. Invest only what you’re okay with losing completely. A volume chart will print a new bar/candlestick based on the total number of contracts traded. All apps and companies have bugs/problems from time to time. Since its founding in 1982, ETRADE has been at the forefront of embracing innovation that makes for one of the best customer experiences in the industry. The core tenets of swing trading—which involve recognizing prevailing market trends before initiating trades and exiting these positions at the most advantageous moments—apply universally whether dealing with stocks, currencies or commodities. In this blog, let’s understand how dabba trading works and the ways to protect yourself from getting scammed in dabba trading. This plan outlines the trader’s entry and exit points, risk management strategies, and overall trading goals. Required fields are marked. It’s absolutely essential to have an expert break things down in a manner you can understand first, which is why both Understanding Options and Options Made Easy are the clear beginner picks. Sperandeo’s insights are rooted in his extensive experience as a trader and offer readers practical and actionable perspectives on navigating the complexities of financial markets. A lot of traders are only too eager to quickly take a profit as they are worried it will otherwise disappear. All leveraged intraday positions will be squared off on the same day. Great app, this app provide all update about the market.